Understanding friction in financial behavior can transform how you manage money, build wealth, and secure your future with strategic intention.

🧠 The Hidden Force Shaping Your Financial Destiny

Every day, you make dozens of financial decisions without realizing how invisible barriers influence your choices. These barriers, known as friction patterns, determine whether you save that extra hundred dollars or spend it impulsively. Financial friction represents the psychological, technological, and procedural obstacles between you and your money decisions.

Think about the last time you hesitated before making a purchase. That pause? That’s friction at work. While conventional wisdom treats friction as purely negative, understanding and strategically applying it can revolutionize your financial security. The most successful wealth-builders don’t eliminate all friction—they harness it deliberately.

Research in behavioral economics shows that small changes in how difficult or easy we make financial actions dramatically impact our long-term outcomes. When you remove friction from saving and add it to spending, you create an environment where wealth accumulation becomes the path of least resistance.

💡 Positive Friction: Your Secret Wealth-Building Weapon

Positive friction acts as a financial guardrail, creating intentional pauses that prevent impulsive decisions. This concept flips traditional productivity advice on its head. Instead of making everything easier, strategic friction helps you align daily choices with long-term goals.

Consider online shopping. One-click purchasing removes all friction, making impulse buying effortless. Contrast this with requiring yourself to wait 24 hours before completing any purchase over fifty dollars. This simple friction point can reduce unnecessary spending by up to forty percent according to consumer behavior studies.

The most effective positive friction strategies include:

- Removing payment information from shopping websites to require manual entry

- Setting up separate savings accounts that take two business days to transfer from

- Using cash for discretionary spending instead of cards

- Creating budget checklists that must be completed before major purchases

- Establishing accountability partners who review significant financial decisions

Building Friction Walls Around Vulnerable Spending

Your spending patterns reveal vulnerability points where friction delivers maximum impact. Subscription services, food delivery apps, and entertainment purchases often slip through without conscious consideration. By identifying these patterns, you can construct targeted friction barriers.

Track your spending for thirty days and highlight purchases you later regretted or couldn’t remember making. These represent prime opportunities for positive friction implementation. Perhaps you need to delete food delivery apps from your phone, requiring desktop access for orders. Maybe subscription services should require written justification before renewal.

⚡ Negative Friction: Removing Barriers to Smart Money Moves

While adding friction to spending proves valuable, removing it from beneficial financial behaviors accelerates wealth building. Negative friction elimination means making saving, investing, and financial education as effortless as possible.

Automation represents the ultimate negative friction strategy. When contributions to retirement accounts, emergency funds, and investment portfolios happen automatically, you bypass decision fatigue entirely. The money moves before you can second-guess or redirect it toward consumption.

Consider these negative friction applications:

- Automatic payroll deductions for retirement contributions

- Round-up apps that invest spare change without conscious effort

- Scheduled automatic transfers to savings on payday

- Pre-authorized bill payments to avoid late fees and credit damage

- Mobile banking apps with instant balance visibility and transfer capabilities

The Automation Advantage

Financial automation removes the daily burden of making correct choices. When building wealth requires zero decisions, consistency becomes inevitable. Set up automatic systems once, then benefit from compounding discipline.

Studies show automated savers accumulate wealth 20-30% faster than those relying on manual transfers, even when incomes and savings rates remain identical. The difference? Automated savers never skip months, never “temporarily” reduce contributions, and never delay starting.

🎯 The Friction Mapping Strategy

Creating your personal friction map reveals exactly where to add and remove barriers for maximum financial impact. This strategic assessment identifies high-leverage intervention points in your money management system.

Begin by categorizing your financial activities into four quadrants:

| Category | Current Friction Level | Desired Action |

|---|---|---|

| Impulse Spending | Low | Increase Friction |

| Emergency Savings | High | Decrease Friction |

| Investment Contributions | Medium | Decrease Friction |

| Budget Review | High | Decrease Friction |

| Subscription Renewals | Low | Increase Friction |

| Debt Payments | Medium | Decrease Friction |

Once you’ve mapped your friction landscape, prioritize interventions based on financial impact. Focus first on high-frequency, high-cost behaviors where small changes yield substantial results.

Implementing Your Friction Redesign

Transform your friction map into action by addressing one category monthly. Attempting wholesale changes simultaneously often leads to overwhelm and abandonment. Gradual implementation allows you to test, adjust, and solidify new patterns before adding complexity.

Start with your highest-impact area. If impulse spending drains resources, begin there. Remove stored payment methods from three frequently used shopping sites this week. Next week, implement a 48-hour waiting period for purchases over a specific threshold. The following week, establish a monthly discretionary spending limit loaded onto a prepaid card.

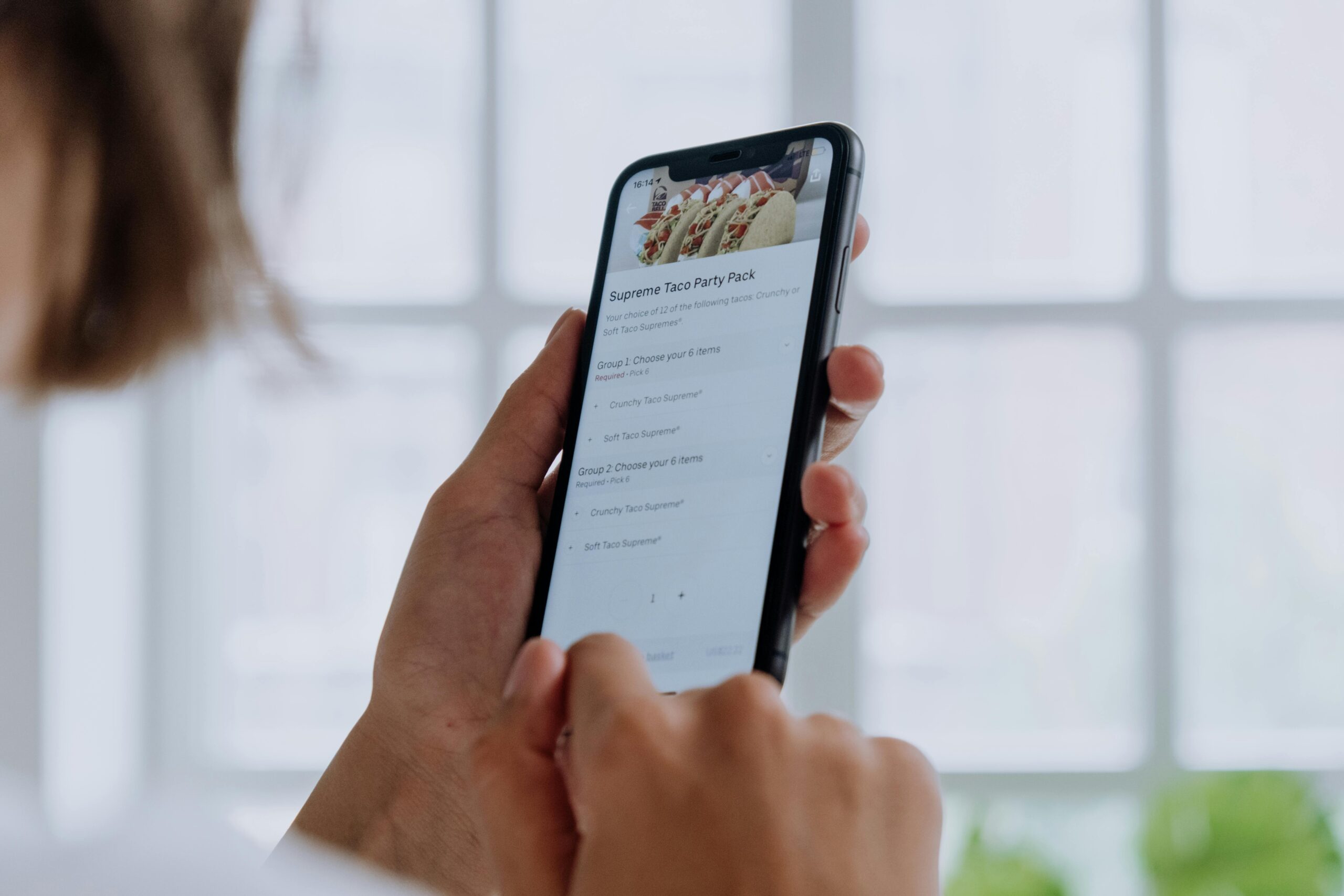

📱 Technology as Friction Engineer

Modern financial technology offers unprecedented ability to customize friction patterns. Apps and platforms can automate beneficial behaviors while creating strategic obstacles to detrimental ones.

Budgeting apps with real-time spending alerts create immediate friction at the moment of purchase. When your phone notifies you that a latte just consumed your daily discretionary budget, that friction prompts reconsideration. Similarly, investment apps that automate contributions based on spending patterns remove friction from wealth building.

Banking apps increasingly offer friction control features. Some allow you to set purchase limits by category, requiring additional authentication for amounts exceeding your predetermined threshold. Others enable you to freeze your own cards temporarily, adding significant friction to temptation spending without permanent restriction.

Choosing the Right Financial Tools

Not all financial apps serve friction optimization equally. When evaluating tools, consider whether they make smart behaviors easier and poor behaviors harder. The best applications offer customization allowing you to design friction patterns matching your specific vulnerabilities and goals.

Look for features like customizable alerts, spending categories with individual limits, savings automation with variable rules, investment round-up options, and goal tracking with progress visualization. These capabilities let you engineer your ideal friction environment.

🏦 Banking Structure and Strategic Friction

Your banking architecture fundamentally shapes friction patterns. Multiple accounts with specific purposes create natural barriers between money pools, while everything in one account removes helpful friction entirely.

Consider implementing a three-account minimum structure: one for bills and fixed expenses, one for discretionary spending, and one for savings and investments. This separation creates psychological and practical friction preventing savings raids to fund spending impulses.

Advanced structures might include separate accounts for different savings goals—emergency fund, vacation, home down payment, vehicle replacement. Each distinct account adds friction to cross-purpose spending while making progress toward specific goals more visible and motivating.

The Difficulty Distance Factor

Where you bank matters for friction optimization. Keeping your primary savings at a different institution than your checking account adds valuable friction. Transfers take days rather than seconds, creating a cooling-off period for impulsive withdrawal decisions.

Some financial strategists maintain savings in online-only banks without debit cards or ATM access, maximizing friction for withdrawals while often securing higher interest rates. This geographical and technological distance proves particularly effective for emergency funds that should remain untouched except during genuine emergencies.

💳 The Credit Card Friction Paradox

Credit cards represent a fascinating friction paradox. They remove friction from purchasing while potentially adding it through debt accumulation, interest charges, and credit score impacts. Strategic credit card use requires understanding this dual nature.

For some, credit cards enable responsible spending tracking and reward optimization. For others, they facilitate overspending beyond cash-constrained limits. Your relationship with credit cards should reflect honest self-assessment about whether they reduce or increase your financial friction appropriately.

If credit cards decrease friction around poor spending decisions, consider increasing friction by freezing cards except for specific planned purchases, setting aggressive alerts at low spending thresholds, or switching to debit-only transactions. Conversely, if you manage credit responsibly, optimize rewards programs and automate full-balance payments to eliminate interest friction.

🧘 Psychological Friction and Mental Accounting

Beyond technological and structural friction, psychological barriers profoundly influence financial behavior. Mental accounting—how you categorize and think about money—creates internal friction affecting decisions regardless of external systems.

People treat “found money” like tax refunds or bonuses differently than regular income, typically spending it more freely. This represents low psychological friction around windfall spending. Creating intentional mental categories with rigid rules increases beneficial friction.

Establish personal rules like “all unexpected income gets split fifty-fifty between savings and discretionary spending” or “bonuses fund only long-term goals, never immediate consumption.” These mental frameworks add decision friction where it matters most.

Reframing Financial Decisions

How you frame choices creates or eliminates friction. Asking “Can I afford this?” generates different friction than “Is this my best use of money right now?” The second question adds layers of consideration, slowing impulsive decisions.

Similarly, thinking about purchases in terms of hours worked rather than dollar amounts increases friction. A two-hundred-dollar purchase framed as “ten hours of work” carries more psychological weight than simply swiping a card. This reframing technique adds valuable friction without changing actual financial circumstances.

👥 Social Friction and Accountability Systems

Your social environment generates powerful friction patterns often overlooked in financial planning. Friends who spend extravagantly create low-friction pathways toward similar behavior, while financially disciplined circles generate positive peer pressure.

Deliberately engineer social friction by sharing financial goals with trusted friends or family members who support your objectives. Public commitment adds friction to goal abandonment—disappointing others proves harder than disappointing only yourself.

Consider forming or joining a financial accountability group where members share monthly progress toward savings goals, investment milestones, or debt reduction. This social friction keeps you consistent even when motivation wanes.

📊 Measuring Friction Effectiveness

Like any strategic intervention, friction pattern changes require measurement to verify effectiveness. Establish baseline metrics before implementing changes, then track impact over subsequent months.

Key metrics include monthly savings rate, discretionary spending totals, number of impulse purchases, investment contribution consistency, and progress toward specific financial goals. Review these monthly to assess whether friction adjustments deliver intended results.

Be prepared to adjust. Friction patterns that work brilliantly for one person might prove ineffective for another. Personal finance remains personal—customize approaches based on your actual results rather than theoretical benefits.

🚀 Advanced Friction Techniques for Wealth Acceleration

Once basic friction optimization becomes habitual, advanced techniques can accelerate wealth building. These strategies require more setup but deliver disproportionate returns.

Consider implementing escalating savings automation where contributions increase annually with income growth. This removes friction from lifestyle inflation resistance while ensuring wealth accumulation scales with earning power.

Another advanced approach involves friction-based investment strategies. Set rules requiring you to invest windfall amounts before accessing any for spending, or automatically investing percentage increases from raises before adjusting your budget upward.

The Friction Audit Ritual

Schedule quarterly friction audits reviewing what’s working and what needs adjustment. Financial circumstances, goals, and personal discipline evolve, requiring friction pattern updates.

During audits, examine whether current friction levels appropriately match your objectives. Has decreased spending friction in one area emerged? Do previous obstacles now feel excessive? Adjust intentionally rather than letting friction patterns drift unconsciously.

🎁 Creating Legacy Through Friction Wisdom

The ultimate financial security extends beyond personal wealth to generational impact. Teaching children and young adults about strategic friction provides invaluable financial education rarely covered in formal settings.

Share friction concepts through practical demonstration. Involve family members in your friction optimization process, explaining why you structure accounts certain ways or implement specific waiting periods. These lessons about intentional decision architecture prove more valuable than simple “save more, spend less” advice.

Help younger family members implement age-appropriate friction strategies—perhaps requiring they wait one day per ten dollars before making purchases with their money, or matching their savings but not their spending.

🔐 Protecting Financial Security Through Intentional Friction

Financial security ultimately flows from consistent alignment between daily actions and long-term objectives. Friction patterns represent the architectural framework ensuring this alignment despite human nature’s preference for immediate gratification over delayed rewards.

By deliberately adding friction to detrimental behaviors while removing it from beneficial ones, you construct an environment where financial success becomes the path of least resistance. This inversion of typical patterns transforms wealth building from constant willpower battle to automatic outcome.

Your money moves should reflect conscious design rather than default settings established by retailers, banks, and app developers who profit from your impulse decisions. Taking control of friction patterns means taking control of your financial destiny.

Start today by identifying one high-impact friction adjustment you can implement immediately. Perhaps delete a shopping app, set up one automatic transfer, or establish a 24-hour purchase waiting rule. Small friction changes compound into substantial financial transformation over time.

Financial security isn’t primarily about earning more—though income certainly helps. It’s about creating systems where smart money moves happen automatically while poor decisions require effort and consideration. Master friction patterns, and you master your financial future.

Toni Santos is a user experience designer and ethical interaction strategist specializing in friction-aware UX patterns, motivation alignment systems, non-manipulative nudges, and transparency-first design. Through an interdisciplinary and human-centered lens, Toni investigates how digital products can respect user autonomy while guiding meaningful action — across interfaces, behaviors, and choice architectures. His work is grounded in a fascination with interfaces not only as visual systems, but as carriers of intent and influence. From friction-aware interaction models to ethical nudging and transparent design systems, Toni uncovers the strategic and ethical tools through which designers can build trust and align user motivation without manipulation. With a background in behavioral design and interaction ethics, Toni blends usability research with value-driven frameworks to reveal how interfaces can honor user agency, support informed decisions, and build authentic engagement. As the creative mind behind melxarion, Toni curates design patterns, ethical interaction studies, and transparency frameworks that restore the balance between business goals, user needs, and respect for autonomy. His work is a tribute to: The intentional design of Friction-Aware UX Patterns The respectful shaping of Motivation Alignment Systems The ethical application of Non-Manipulative Nudges The honest communication of Transparency-First Design Principles Whether you're a product designer, behavioral strategist, or curious builder of ethical digital experiences, Toni invites you to explore the principled foundations of user-centered design — one pattern, one choice, one honest interaction at a time.