Managing your money doesn’t have to feel like walking through a minefield. A positive, empowering approach to personal finance creates lasting success without the stress and anxiety that fear-based tactics often generate.

💚 The Psychology Behind Positive Financial Motivation

Traditional financial advice has long relied on scare tactics: “You’ll be broke in retirement!” or “You’re one emergency away from disaster!” While these warnings may grab attention, they rarely create sustainable behavioral change. Research in behavioral economics shows that positive reinforcement and gentle guidance lead to better long-term financial habits than fear-mongering ever could.

When we approach money management from a place of empowerment rather than fear, our brains respond differently. The prefrontal cortex, responsible for planning and decision-making, functions more effectively when we’re calm and optimistic. Conversely, fear triggers our amygdala, leading to hasty decisions or complete paralysis.

This psychological reality means that building financial confidence through small wins and positive reinforcement creates a foundation for genuine wealth-building. You’re more likely to stick with a budget that celebrates your progress than one that constantly reminds you of past failures.

Understanding Your Financial Starting Point

Before implementing any financial strategy, you need to know where you stand—not to judge yourself, but to create an accurate roadmap. Think of this as taking your financial temperature, not diagnosing a terminal illness.

Begin by gathering your financial information in one place. This includes bank statements, credit card balances, loan documents, and investment accounts. Many people avoid this step because they fear what they’ll discover, but knowledge is genuinely powerful here.

Creating Your Financial Snapshot Without Judgment

Your current financial situation is simply data—it’s not a reflection of your worth as a person. Whether you have $100 or $100,000 in savings, you’re starting from exactly where you need to begin your journey.

Consider using a financial tracking app that presents information clearly without overwhelming you with complex charts or alarming red indicators. The goal is clarity, not anxiety.

🌱 Small Steps That Create Big Financial Changes

The compound effect applies not just to money, but to habits themselves. Small, consistent actions accumulate into remarkable results over time. This principle is your greatest ally in transforming your financial life.

Rather than attempting a complete financial overhaul overnight, focus on implementing one new positive habit at a time. This approach prevents overwhelm and allows each habit to become automatic before adding another layer.

The Power of Micro-Savings

Start by saving amounts so small they feel almost laughable. Set aside $1 per day, or even $5 per week. The specific amount matters far less than establishing the habit itself. Once saving becomes automatic, increasing the amount happens naturally.

Consider this approach: every time you make a purchase, round up to the nearest dollar and transfer the difference to savings. This creates dozens of tiny deposits throughout the month, accumulating without noticeable sacrifice.

Gentle Budget Adjustments

Traditional budgeting often feels restrictive, like putting yourself on a financial diet. Instead, try gentle reallocation. Identify one expense category where you could comfortably reduce spending by 5-10% without significant sacrifice.

Perhaps you’re spending $200 monthly on dining out. Rather than slashing this to $50 and feeling deprived, try reducing to $180. That $20 difference goes toward savings or debt reduction, and you’ve barely noticed the change.

Building an Emergency Fund Without Panic

Financial experts often frighten people with statistics about Americans lacking emergency savings. While preparedness matters, approaching this goal with gentle determination proves more effective than manufactured urgency.

Your first emergency fund goal shouldn’t be six months of expenses—that number feels insurmountable when you’re starting from zero. Instead, aim for $500 first. This amount covers most unexpected car repairs or medical copays, immediately reducing financial vulnerability.

Once you’ve reached $500, celebrate! You’ve achieved something many adults never accomplish. Then set your sights on $1,000, then one month of expenses, gradually building toward that larger goal.

Where to Keep Your Emergency Money

Your emergency fund should be instantly accessible but separate from your everyday checking account. A high-yield savings account provides easy access while earning modest interest and creating psychological separation from daily spending money.

The key is removing friction from saving while adding slight friction to spending. You want your emergency fund available within 24 hours, but not so immediately accessible that you’re tempted to dip into it for non-emergencies.

💳 Debt Management Through Positive Action

Debt often carries tremendous emotional weight, but viewing it as a manageable challenge rather than a personal failure changes everything. Your debt represents past decisions, not future limitations.

The debt snowball method exemplifies gentle, encouraging financial strategy. Rather than focusing on interest rates, you target your smallest debt first. Why? Because paying off that first balance—even if it’s just $200—provides a psychological victory that fuels continued progress.

Reframing Your Relationship With Debt

Instead of seeing yourself as “buried in debt,” try “actively reducing my obligations.” This linguistic shift seems minor but profoundly affects your mindset. You’re not a victim of circumstances; you’re someone taking constructive action.

Track your debt reduction visually with a simple chart or app that shows declining balances. Watching that line trend downward reinforces positive behavior and maintains motivation through the inevitable challenging moments.

Investing: Starting Before You Feel Ready

Many people postpone investing because they believe they need extensive knowledge or substantial capital first. This waiting game costs more than any beginner mistake possibly could, thanks to lost compounding time.

You can begin investing with amounts as small as $5 or $10. Fractional shares and micro-investing platforms have democratized market participation, eliminating the old barriers to entry.

Investment Basics Without the Jargon

At its core, investing means putting your money to work earning more money. When you invest in index funds, you’re buying tiny pieces of hundreds or thousands of companies. As these companies grow and profit, your investment grows too.

Start with a simple target-date fund or broad market index fund. These require minimal decision-making while providing instant diversification. As you become more comfortable, you can explore additional options.

The “Set It and Forget It” Advantage

Automatic investment contributions remove emotion from the equation. When a preset amount transfers from your checking to your investment account every payday, you’re investing consistently regardless of market conditions or your mood.

This approach also leverages dollar-cost averaging, where you buy more shares when prices are low and fewer when prices are high, smoothing out market volatility over time.

🎯 Goal-Setting That Motivates Rather Than Overwhelms

Financial goals should inspire action, not create anxiety. The problem with many financial goals is they’re either too vague (“save more money”) or too ambitious (“become a millionaire by 40”) to effectively guide daily decisions.

Effective financial goals follow a middle path: specific enough to be actionable, challenging enough to be meaningful, but achievable enough to maintain motivation.

The Three-Tier Goal Framework

Structure your financial goals in three timeframes: immediate (within 3 months), near-term (3-12 months), and long-range (1+ years). This creates wins at regular intervals while maintaining progress toward bigger objectives.

Your immediate goal might be “save $300 for a small emergency fund.” Your near-term goal could be “pay off my smallest credit card.” Your long-range goal might involve “build a down payment for a home” or “establish a retirement account.”

Financial Education Without Information Overload

The personal finance space overflows with information, much of it contradictory. One expert insists you must invest aggressively; another preaches extreme frugality. This cacophony often leads to decision paralysis.

Instead of consuming endless financial content, focus on learning one concept at a time and implementing it before moving to the next. Understanding compounds when you actually apply knowledge rather than simply collecting information.

Curated Learning Approach

Choose one financial topic per month to explore deeply. January might be budgeting basics, February could cover credit scores, March might focus on investment fundamentals. This structured approach prevents overwhelm while building comprehensive financial literacy over time.

Seek out resources that explain concepts clearly without resorting to fear tactics or making you feel inadequate. Quality financial education empowers you to make informed decisions aligned with your values and circumstances.

📱 Technology as Your Financial Ally

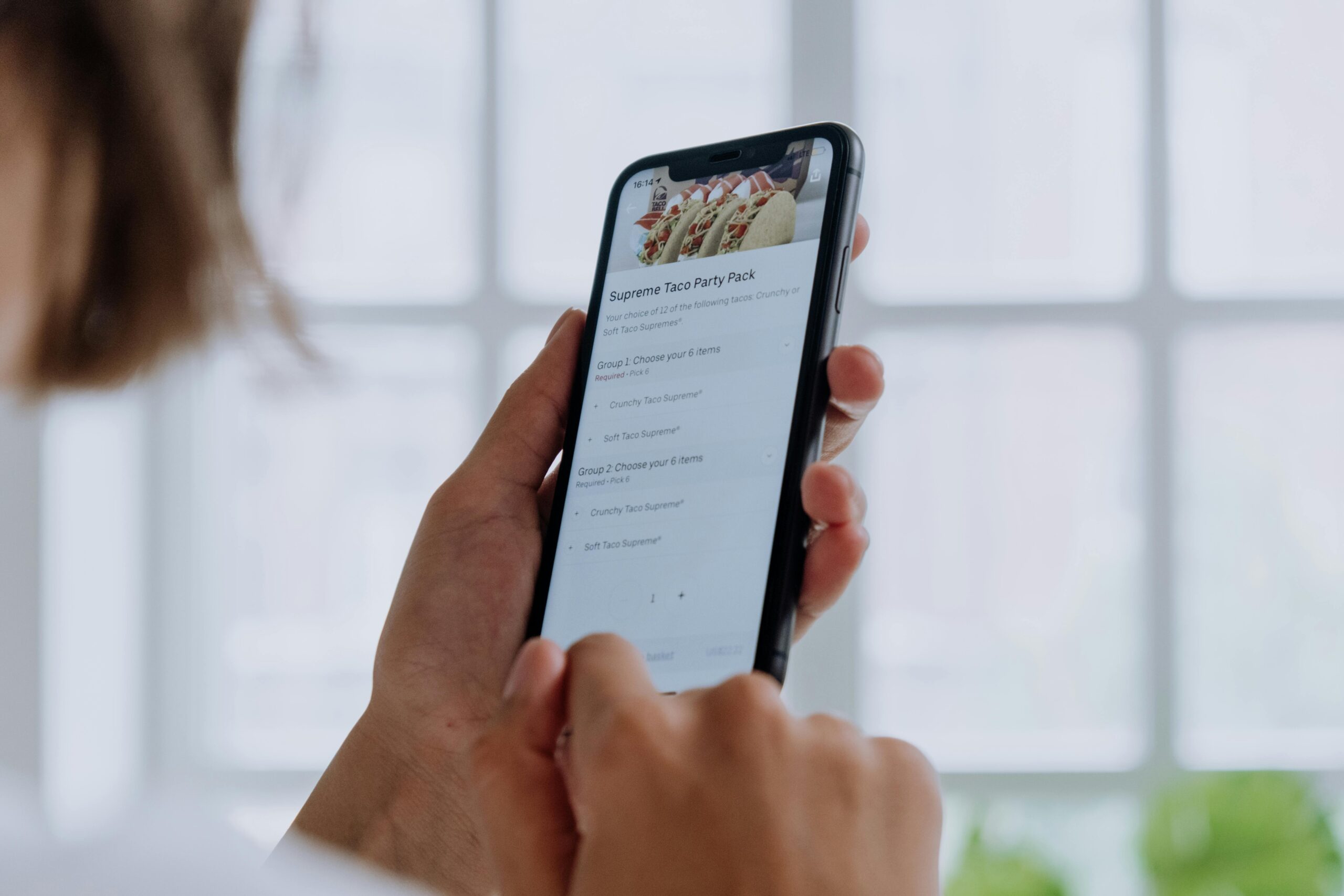

Modern financial technology can simplify money management significantly when chosen thoughtfully. The right tools provide clarity and automation without adding complexity or anxiety to your financial life.

Budgeting apps that sync with your accounts offer real-time spending awareness without requiring manual entry of every transaction. Some apps even use artificial intelligence to categorize expenses automatically and identify saving opportunities.

Investment platforms with educational components help you learn while you build wealth. Many offer retirement calculators, goal-planning tools, and straightforward interfaces designed for beginners.

Choosing Financial Apps Wisely

Not every financial app deserves space on your phone. Evaluate tools based on whether they simplify your financial life or add unnecessary complexity. The best apps work quietly in the background, supporting your goals without demanding constant attention.

Look for apps with positive user interfaces that celebrate progress rather than highlighting shortcomings. Features like savings milestones, debt reduction trackers, and spending insights should feel encouraging rather than judgmental.

💪 Building Financial Resilience and Confidence

Financial success isn’t ultimately about the numbers in your account—it’s about developing confidence in your ability to make sound decisions and adapt to changing circumstances. This resilience becomes your greatest financial asset.

Every small financial victory, whether it’s sticking to your budget for a week or making an extra debt payment, strengthens your financial self-efficacy. You begin to see yourself as someone capable of managing money effectively.

Celebrating Milestones Appropriately

Acknowledge your financial progress with celebrations that don’t undermine your goals. Paid off a credit card? Enjoy a modest dinner out rather than a weekend trip. Reached a savings milestone? Treat yourself to something small you’ve wanted.

These celebrations reinforce positive behavior while maintaining momentum toward larger objectives. You’re creating sustainable habits, not practicing temporary deprivation.

Community and Accountability Without Competition

Sharing your financial journey with supportive people creates accountability while reducing isolation. However, this sharing must happen in environments that encourage rather than judge.

Find or create accountability partnerships with people pursuing similar goals. Regular check-ins about progress, challenges, and strategies help everyone stay on track while providing mutual support.

Avoid comparison with others’ financial situations. Your colleague’s salary, your neighbor’s house, or your friend’s vacation have no bearing on your personal financial success. Your only meaningful comparison is with your past self.

🌟 Maintaining Momentum Through Challenges

Financial progress rarely follows a straight line. Unexpected expenses arise, income fluctuates, and motivation naturally ebbs and flows. Anticipating these realities allows you to navigate them without derailing completely.

When you face a financial setback, respond with curiosity rather than harsh self-judgment. What caused this situation? What can you learn? How might you handle similar circumstances differently in the future?

The Reset Button Mindset

Every day offers a fresh opportunity to make positive financial choices. A week of overspending doesn’t negate months of progress, nor does it predict future behavior. Simply reset and resume your positive habits without dwelling on the slip.

This forgiving approach to financial management proves far more sustainable than perfectionism. You’re cultivating lifelong habits, not completing a short-term challenge.

Creating Your Personalized Financial Philosophy

Generic financial advice rarely accounts for your unique values, circumstances, and goals. Developing your personal financial philosophy ensures your money management aligns with what truly matters to you.

Consider what financial security means to you specifically. For some, it’s career flexibility; for others, it’s travel opportunities or supporting causes they believe in. Your financial strategies should serve these deeper values rather than arbitrary external standards.

This personalization makes financial discipline feel less like restriction and more like actively choosing what matters most. You’re not sacrificing; you’re prioritizing.

Looking Forward With Optimism and Realism

Financial empowerment comes from balancing optimism about what’s possible with realism about current circumstances. You don’t need to ignore challenges, but you also shouldn’t let them define your financial future.

The financial habits you build today compound into tomorrow’s security and freedom. Each small positive action—every dollar saved, every informed decision, every moment of choosing long-term benefit over short-term impulse—accumulates into substantial change.

Your financial journey is uniquely yours. Progress happens at different paces for different people based on countless variables. What matters is consistent forward movement, however incremental it may sometimes feel.

By approaching your finances with gentle determination rather than fear, you create space for sustainable growth. You’re not being scared into compliance with someone else’s rules; you’re actively building the financial life that supports your authentic goals and values. This empowerment, more than any specific dollar amount, represents true financial success.

Toni Santos is a user experience designer and ethical interaction strategist specializing in friction-aware UX patterns, motivation alignment systems, non-manipulative nudges, and transparency-first design. Through an interdisciplinary and human-centered lens, Toni investigates how digital products can respect user autonomy while guiding meaningful action — across interfaces, behaviors, and choice architectures. His work is grounded in a fascination with interfaces not only as visual systems, but as carriers of intent and influence. From friction-aware interaction models to ethical nudging and transparent design systems, Toni uncovers the strategic and ethical tools through which designers can build trust and align user motivation without manipulation. With a background in behavioral design and interaction ethics, Toni blends usability research with value-driven frameworks to reveal how interfaces can honor user agency, support informed decisions, and build authentic engagement. As the creative mind behind melxarion, Toni curates design patterns, ethical interaction studies, and transparency frameworks that restore the balance between business goals, user needs, and respect for autonomy. His work is a tribute to: The intentional design of Friction-Aware UX Patterns The respectful shaping of Motivation Alignment Systems The ethical application of Non-Manipulative Nudges The honest communication of Transparency-First Design Principles Whether you're a product designer, behavioral strategist, or curious builder of ethical digital experiences, Toni invites you to explore the principled foundations of user-centered design — one pattern, one choice, one honest interaction at a time.